EB5 Visa for Investors

9 Simple Techniques For Eb5 Visa

Table of ContentsThe Ultimate Guide To Eb5 VisaThe Main Principles Of Eb5 Visa 5 Simple Techniques For Eb5 VisaThe 6-Minute Rule for Eb5 VisaGetting My Eb5 copyright WorkThe Eb5 Visa Diaries

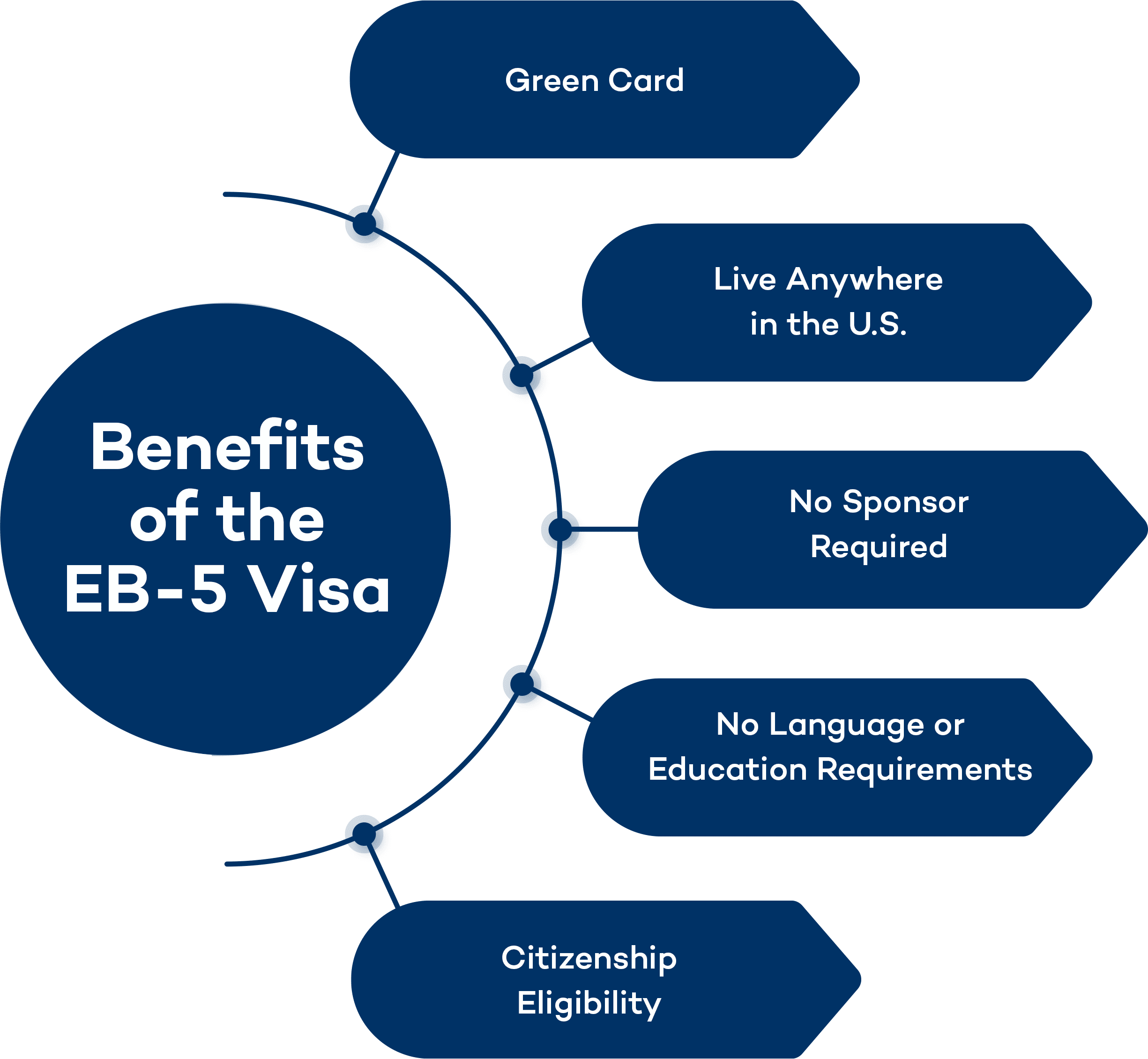

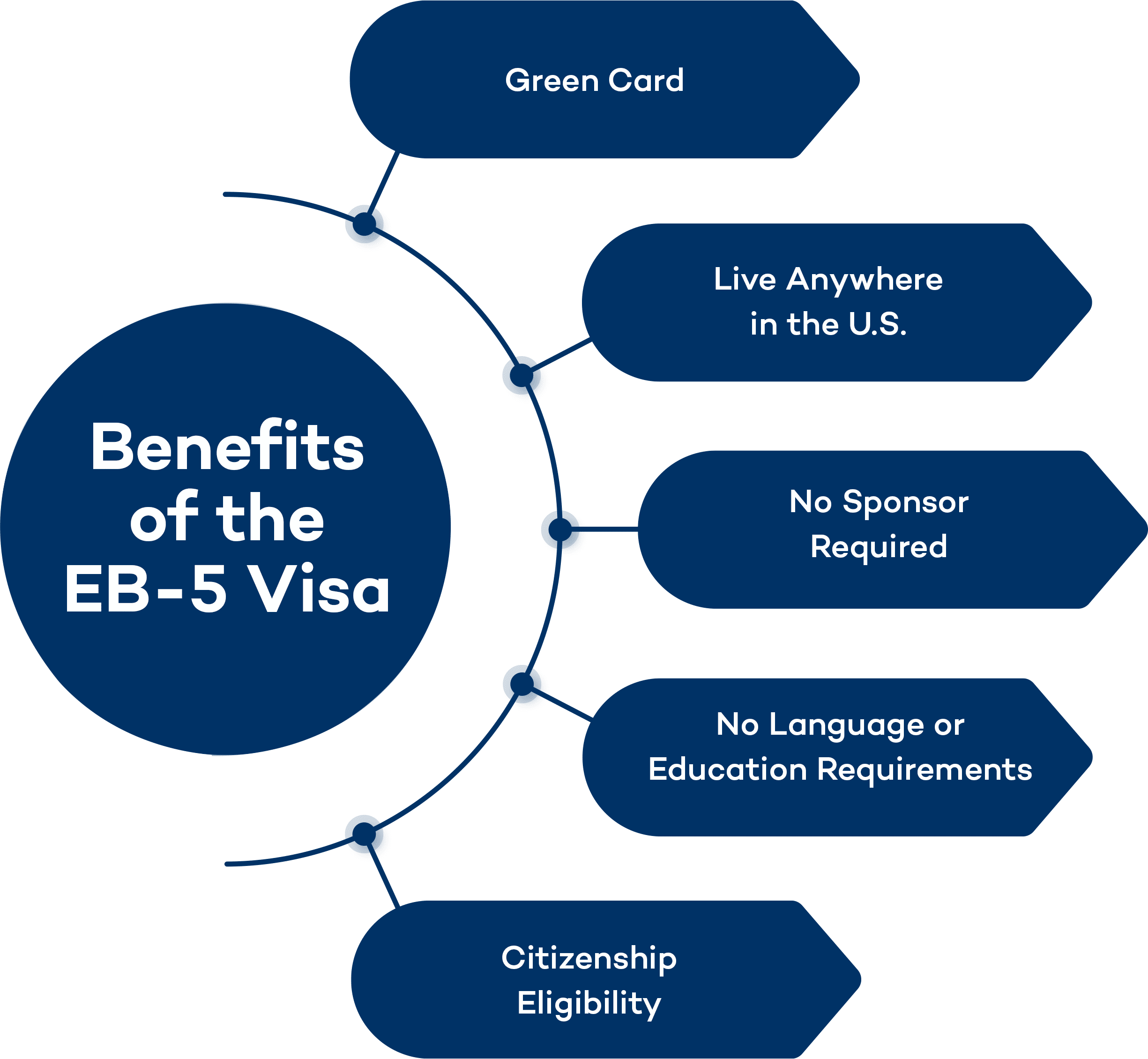

Realty Financial investment: Eco-friendly card holders encounter fewer constraints when buying realty in the U.S. They can get home for personal usage or as a financial investment without added scrutiny or restrictions, which can be especially valuable in areas with high property recognition rates. Access to Credit scores: Permanent citizens have a much easier time establishing credit score in the U.SThey can get mortgages, service loans, and bank card with a lot more desirable terms contrasted to non-residents. This enhanced access to credit can help with additional investments and monetary development. Take into consideration the adhering to differences in between various visa enters the united state to determine the very best choice for your circumstance. The EB-5 environment-friendly card supplies long-term residency without work constraints, unlike the H-1B visa, which is short-lived and links the owner to a details company and work function.

The Buzz on Eb5 Visa

Ongoing Surveillance and Transparency: Regional facilities will certainly provide normal updates on project progress and compliance with EB-5 requirements. This openness allows investors to remain educated concerning their financial investment and migration standing. Problem-Solving Capabilities: In instance of unexpected issues, your local facility will depend on its competence to find solutions. The Behring Group has a 100% capitalist authorization price with USCIS throughout all last adjudicated applications, providing you the assurance that we will handle your EB-5 project throughout.

Under the Biden management, which is generally a lot more immigration-friendly, there are expectations of boosted handling times. Secretary of Homeland Safety Alejandro Mayorkas, that previously led USCIS, is prepared for to add to these renovations. In addition, during the 2008 recession, EB-5 played a significant role in economic recuperation, suggesting federal government support for the program during the present financial rebound.

Congress has established assumptions for USCIS to accomplish handling times of no longer than 6 months and to accumulate costs adequate to meet this target. In summary, these measures and reforms show USCIS's commitment to boosting processing times for EB-5 applications and delivering more effective solutions to investors. The opportunities of success in the EB-5 program can vary based on different variables.

Eb5 Visa for Dummies

File Kind I-829 after 1 year and 9 months to get rid of problems on permanent residency. When it comes to making a decision where to invest and finding appropriate EB-5 projects, there are a few methods to consider.

This allows them to assess the task firsthand, consult with the designer and management group, and make an enlightened financial investment choice. On the various other hand, dealing with a broker supplier agent supplies investors with a broader choice of financial investment choices. The due persistance process is normally conducted at the EB-5 Funds' cost, easing capitalists of this responsibility.

When an EB-5 task is granted expedited standing by USCIS, it shows that the task is considered to serve an urgent federal government or public interest. This designation leads to much shorter handling times for the linked petitions. In many cases, we have actually observed that capitalists in expedited projects have actually obtained authorization in much less than 6 months, or perhaps considerably sooner.

Eb5 Visa Fundamentals Explained

Financiers must maintain a detailed approach to due persistance and thoroughly assess the financial investment job, no matter its expedited condition. In the realm of EB-5 investments, the bulk find out more of investments are structured to fulfill the needs of a Targeted Employment Location (TEA). By locating the financial investment in a TEA, capitalists end up being eligible for the reduced investment threshold, which currently stands at $800,000. Purchasing a TEA not just allows investors to make a reduced funding financial investment however additionally offers a brand-new class of visas that have no waiting line, and investments right into a backwoods receive top priority handling.

These non-TEA jobs may offer different investment opportunities and job kinds, providing to capitalists with varying preferences and purposes. Eventually, the choice to invest in a TEA or non-TEA task depends on an individual's economic capacities, financial investment objectives, threat resistance, and placement with their personal choices.

It is important for capitalists to take the necessary time to perform detailed research study and testimonial prior to continuing with the filing to make certain an effective and well-documented application.

All About Eb5 Visa

Recently, these investments have actually given Return of investments ranging from 0.25% to 8% per annum. However, it's important to comprehend that these returns specify to investments offered and vary depending on the individual job's characteristics. EB-5 investments generally have additional costs connected with structuring the financial investment within the program's demands. There is a degree of unpredictability concerning when the spent resources will be offered to the project.

It's important for financiers to consider the one-of-a-kind aspects of EB-5 financial investments when examining ROI assumptions. Aspects such as the task's service design, monetary forecasts, market conditions, and the timing of resources deployment must be extensively evaluated. While ROI is an important consideration, investors ought to weigh the advantages of the EB-5 program - getting permanent residency in the USA.

The Facts About Eb5 Visa Revealed

The timing click here of when investors can anticipate to find out more obtain their EB-5 funds back is dependent on a number of aspects. It is vital for capitalists to have a clear understanding of the nature of their financial investment and the terms laid out in the operating contract. It's crucial to recognize that capitalists are making an equity financial investment in the New Commercial Business (NCE), which after that offers a financing to the Job Creating Entity (JCE).

To evaluate the timing of the car loan settlement by the JCE, financiers need to thoroughly review the lending terms. This consists of understanding when the lending begins, the timeline for payment, and any type of provisions for possible extensions. By having a clear understanding of the lending terms, capitalists can approximate when they might obtain their first financial investment back from the JCE.Furthermore, as soon as the funds are gone back to the NCE, there might be opportunities for reinvestment.

This arrangement provides details on when and how the NCE will be dissolved, enabling capitalists to have a concept of when they could anticipate to obtain their funding back. Capitalists need to carefully review the operating agreement and consult with lawful and monetary experts to make sure a complete understanding of the financial investment framework, timing, and prospective returns.

In the context of EB-5 investments, it is essential to stress that there can be no guarantee or assurance of when an investor will get settlement of their funds. Actually, if such a warranty exists, it can increase worries and possibly cause the denial of the investor's EB-5 request by USCIS.